UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the RegistrantxRegistrant☒ Filed by a Party other than the Registrant¨Registrant☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

NORTHWEST PIPE COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

☐ |

| Fee paid previously with preliminary materials: | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) | Amount previously paid: |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

April 17, 2017

April 18, 2014

Dear Fellow Shareholder:

You are cordially invited to attend the 20142017 Annual Meeting of Shareholders. We will hold our meeting on Thursday, May 29, 2014,June 1, 2017, at 9:8:00 a.m. Pacific Time at the Sheraton Portland Airport Hotel,Heathman Lodge located at 82357801 NE Airport Way, Portland, Oregon.Greenwood Drive, Vancouver, Washington.

YOUR VOTE IS IMPORTANT. As a shareholder of Northwest Pipe Company, you can play an important role in our Company by considering and taking action on the matters set forth in the attached Proxy Statement. We appreciate the time and attention you invest in making thoughtful decisions.

I, along with my fellow Board members, wish to acknowledgerecognize James Declusin for his six years of dedicated service on the hard work and dedication of our former Chairman Bill Tagmyer, whoBoard, which was greatly appreciated. Mr. Declusin passed away in September. Bill made a number of significant contributions to our success over the years and is greatly missed.2016.

Thank you for your support and continued interest in Northwest Pipe Company.

Sincerely, | |

| |

Scott Montross | |

President and Chief Executive Officer |

Scott J. Montross

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Northwest Pipe Company:

The 20142017 Annual Meeting of Shareholders (the “Annual Meeting”) of Northwest Pipe Company (the “Company”) will be held on Thursday, May 29, 2014,June 1, 2017, at 9:8:00 a.m. Pacific Time at the Sheraton Portland Airport Hotel,Heathman Lodge located at 82357801 NE Airport Way, Portland, Oregon.Greenwood Drive, Vancouver, Washington. The purposes of the Annual Meeting will be:

1. | To elect three directors, two |

2. | To hold an advisory vote on the Company’s executive compensation; |

3. | To hold an advisory vote on the frequency of shareholder advisory votes on executive compensation; |

4. | To ratify the appointment of |

5. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on April 11, 201413, 2017 are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the Meeting.

It is important that your shares be represented and voted at the meeting. Please complete, sign and return your proxy card, or use the Internet or telephone voting systems.

We are enclosing a copy of the 20132016 Annual Report to Shareholders with this Notice and Proxy Statement.

By Order of the Board of Directors,

| By Order of the Board of Directors, |

| |

Scott Montross | |

President and Chief Executive Officer |

Vancouver, Washington

April 18, 201417, 2017

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ONJUNE 1, 2017: ThisProxyStatement and the Company’s 2016 Annual Report to Shareholders are also available at https://materials.proxyvote.com/667746 |

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 29, 2014:

This Proxy Statement and the Company’s 2013 Annual Report to Shareholders are also available at

www.nwpipe.com/proxy

PROXY STATEMENT FOR THE

20142017 ANNUAL MEETING OF SHAREHOLDERS OF

NORTHWEST PIPE COMPANY

Page | ||||

1 | ||||

2 | ||||

2 | ||||

2 | ||||

3 | ||||

3 | ||||

3 | ||||

4 | ||||

4 | ||||

4 | ||||

5 | ||||

5 | ||||

6 | ||||

6 | ||||

6 | ||||

7 | ||||

9 | ||||

9 | ||||

9 | ||||

10 | ||||

11 | ||||

11 | ||||

13 | ||||

13 | ||||

13 | ||||

13 | ||||

14 | ||||

15 | ||||

15 | ||||

15 | ||||

15 | ||||

16 | ||||

16 | ||||

18 | ||||

19 | ||||

20 | ||||

20 | ||||

21 | ||||

| Page | ||||

21 | ||||

22 | ||||

23 | ||||

23 | ||||

24 | ||||

25 | ||||

26 | ||||

27 | ||||

27 | ||||

29 | ||||

31 | ||||

Disclosure of Fees Paid to Independent Registered Public Accounting Firm | 31 | |||

31 | ||||

Proposal No. | 32 | |||

33 | ||||

33 | ||||

34 | ||||

36 | ||||

36 | ||||

Questions and Answers About the Proxy Materials and the Annual Meeting | 37 | |||

43 |

NORTHWEST PIPE COMPANY

5721 SE Columbia Way, Suite 200

Vancouver, Washington 98661

(360) 397-6250

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 29, 2014JUNE 1, 2017

This Proxy Statement and the accompanying 2013Annual Report on Form 10-K and Amendment No. 1 on Form 10-K/A for the year ended December 31, 2016 (as so amended, “2016 Annual Report to ShareholdersShareholders”), as filed with the U.S. Securities and Exchange Commission (the “SEC”) are being furnished to the shareholders of Northwest Pipe Company, an Oregon corporation (the “Company”), as part of the solicitation of proxies by the Company’s Board of Directors (the “Board of Directors”) for use at the Company’s annual meeting of shareholders (the “Annual Meeting”) to be held on Thursday, May 29, 2014,June 1, 2017 at 9:8:00 a.m. Pacific Time at the Sheraton Portland Airport Hotel,Heathman Lodge located at 82357801 NE Airport Way, Portland, Oregon.Greenwood Drive, Vancouver, Washington.

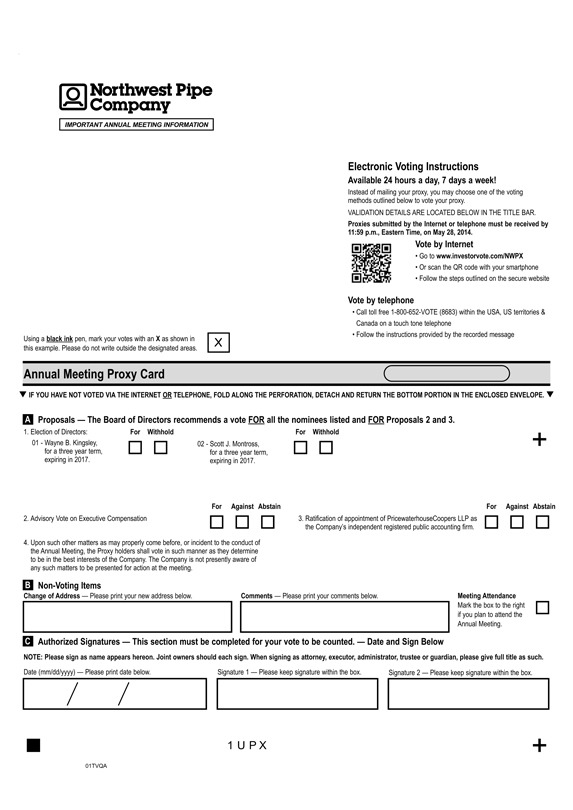

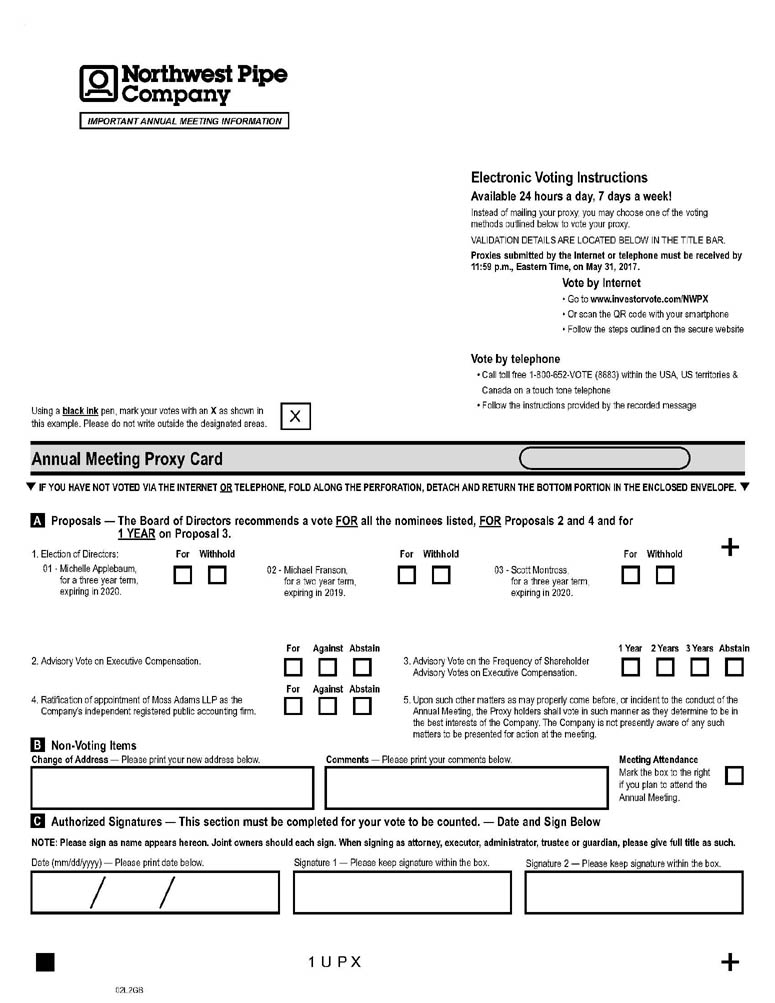

At the Annual Meeting, shareholders will be asked to vote on the following matters:

1. | The election of three directors, two |

2. | An advisory vote on the Company’s executive compensation; |

3. | An advisory vote on the frequency of shareholder advisory votes on executive compensation; |

4. | The ratification of the appointment of |

5. | Such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

This Proxy Statement, together with the enclosed proxy card and the 20132016 Annual Report to Shareholders, are first being mailed to shareholders of the Company on or about April 29, 2014.28, 2017.

The Board of Directors has fixed the close of business on April 11, 201413, 2017 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of Common Stock at the close of business on such date will be entitled to vote at the Annual Meeting, with each such share entitling its owner to one vote on all matters properly presented at the Annual Meeting. On the record date, there were 9,508,9179,604,811 shares of Common Stock then outstanding, with each share of Common Stock being entitled to one vote.

If the enclosed form of proxy is properly executed and returned in time to be voted at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.Executed but unmarked proxies will be voted in accordance with the recommendations of the Board of Directors.

Shareholders who execute proxies retain the right to revoke them at any time prior to the exercise of the powers conferred thereby by filing a written notice of revocation with, or by delivering a duly executed proxy bearing a later date to:to the Company’s Corporate Secretary, Northwest Pipe Company, 5721 SE Columbia Way, Suite 200, Vancouver, Washington 98661, or by attending the Annual Meeting and voting in person. All valid, unrevoked proxies will be voted at the Annual Meeting.

CORPORATEGOVERNANCE

Our Board of Directors and management have committed themselves to establishing a strong corporate governance environment and to adopting the best practices as they mostto meet the needs and goals of the Company. As part of that commitment, we have adopted Corporate Governance Principles, which cover such topics as qualifications and independence of Board members, the selection, orientation and continuing education of Board members, as well as other topics designed to promote effective governance by the Board of Directors. We have also adopted a Code of Business Conduct and Ethics, which applies to all employees, officers and directors of the Company and sets forth guidance to help in recognizing and dealing with ethical issues, to provide mechanisms for reporting unethical conduct, and to promote a culture of honesty and accountability.accountability, and a Code of Ethics for Senior Financial Officers, which applies to our senior financial officers and sets forth guidance to deter wrongdoing, promote honest and ethical conduct and promote a culture of integrity and fairness. Copies of our Corporate Governance Principles, and Code of Business Conduct and Ethics and Code of Ethics for Senior Financial Officers are available on the Company’s website atwww.nwpipe.com under the heading“Investor Relations” - “Corporate Governance”, or by writing to the Company’s Corporate Secretary, Northwest Pipe Company, attn. Corporate Secretary, 5721 SE Columbia Way, Suite 200, Vancouver, WAWashington 98661.

We have also adopted a Policy for Reporting Financial Irregularities (“Whistleblower Policy”), which is intended to create a workplace environment that encourages the highest standards of ethical, moral, and legal business conduct. The Whistleblower Policy establishes procedures for any person to confidentially and anonymously report violations by us or any of our personnel of our Code of Business Conduct and Ethics or any laws, rules or regulations without fear of retaliation. The Whistleblower Policy also contains procedures for submission of complaints involving our accounting practices and internal accounting controls.

While directors are elected by a plurality of votes cast, our Corporate Governance Principles include a director resignation policy, requiring a director who receives more votes “withheld” than in favor of election in an uncontested election to tender an offer of his or her resignation to the Board.Board for consideration. The Nominating and Governance Committee shall recommend to the Board the action to be taken with respect to such offer of resignation, and the Board shall act promptly with respectdetermine whether to eachaccept such letter of resignation, and shall publicly disclose its decision and rationale.

The current Board of Directors consists of sevensix directors, two of whom are currently employed by the Company (Messrs. Montross and Roman). The Board of Directors has affirmatively determined that all of the non-employee directors (Messrs. Declusin,(Ms. Applebaum and Messrs. Demorest, Franson Kingsley and Larson) are “independent” in accordance with the standards of the Nasdaq Stock Market and as defined by the director independence guidelines included in our Corporate Governance Principles.

BoardBoard Leadership Structure and Risk Oversight

The Company’s Corporate Governance Principles provide that the independent members of the Board of Directors will select a lead director from among the independent directors if the positions of Chairman of the Board and Chief Executive Officer (“CEO”) are held by the same person or if the Chairman of the Board is not an independent director. The responsibilities of the Chairman of the Board include the following: set Board meeting agendas in collaboration with the CEO; preside at Board meetings and the annual shareholdersshareholders’ meeting; assign tasks to the appropriate committees; and ensure that information flows openly between management and the Board. The responsibilities of the lead director include the following: coordinate the activities of the independent directors; make recommendations to the CEO in setting Board meeting agendas on matters concerning the independent directors; prepare the agenda for executive sessions of the independent directors, chair those sessions and be primarily responsible for communications between the independent directors and the CEO. Richard A. Roman, the Chairman of our Board of Directors, is not “independent” within the meaning of the applicable rules of the Nasdaq Stock Market. Accordingly, in December 2010, the remaining directors appointed James E. Declusin as the Board’s Lead Director, who served until his death in June 2016. In August 2016, Michael Franson was elected to the Board of Directors and appointed as the Board’s Lead Director.

The Board of Directors oversees management’s Company-wide risk management activities. Management’s risk management activities which include assessing and taking actions necessary to manage risks incurred in connection with the long-term strategic direction of the Company and the operation of our business. The Board of Directors uses its committees to assist in its risk oversight function. The Compensation Committee is responsible for oversight of risk associated with our compensation plans. The Nominating and Governance Committee is responsible for oversight of board processes and corporate governance-related risk. The Audit Committee is responsible for oversight of our financial reporting process, financial internal controls and compliance activities, the qualification, independence and performance of our independent auditors and compliance with applicable legal and regulatory compliance requirements. The Board of Directors maintains overall responsibility for oversight of the work of its various committees by having regular reports from the chairman of each Committee with respect to the work performed by his respective Committee. In addition, discussions with the Board about the Company’s strategic plan, financial results, capital structure, merger and acquisition related activity and other business discussed with the Board generally includesinclude discussion of the risks associated with the matters under consideration.

BoardBoard of Directors Meetings

Regular attendance at the Board meetings and the Annual Meeting is required of each director. The Board of Directors met six timesheld nine meetings during 2013.2016. Each directorof the directors attended more than 75 percent75% of the aggregate of (i) the total number of Board and applicable Committee meetings during his or her tenure in 2016. In addition, all of the Boarddirectors, with the exception of Directors and (ii) the total number of meetings held by all committees of the Board on which he served. Members of the Board of Directors are also encouraged to attend the Company’s annual meeting of shareholders each year. All of the members of the Board of DirectorsJames Declusin, attended the Company’s 20132016 Annual Meeting of Shareholders.

BoardBoard of Directors Committees

The Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. Each of the Committees consists of independent directors and each of the Committees has adopted a written charter which is available on the Company’s website atwww.nwpipe.comunder the heading“Investor Relations” - “Corporate Governance”,Governance,” or by writing to the Company’s Corporate Secretary, Northwest Pipe Company, attn. Corporate Secretary, 5721 SE Columbia Way, Suite 200, Vancouver, WAWashington 98661.

The table below lists the current membership of each Committee.

Audit | Compensation | Nominating | ||||||||||

Name: | ||||||||||||

| ||||||||||||

| X | |||||||||||

| X | |||||||||||

| X* | X | ||||||||||

Michael Franson | X | X* | ||||||||||

Keith | X | X* | ||||||||||

____________

* | Committee Chairman |

AuditAudit Committee.The Audit Committee of the Board of Directors is responsible for the oversight and monitoring of: the integrity of the Company’s financial reporting process, financial internal control systems, accounting and legal compliance and the integrity of our financial reporting; the qualifications, independence and performance of our independent auditors; our compliance with applicable legal and regulatory requirements; and the maintenance of open and private, if necessary, communication among the independent auditors, management, legal counsel and the Board. The Audit Committee met 8seven times in 2013.2016. Each member of the Audit Committee is “independent” as defined by applicable U.S. Securities and Exchange Commission (“SEC”)SEC and Nasdaq Stock Market rules. The Board of Directors has determined that Mr.Messrs. Demorest and Mr. Larson and Ms. Applebaum each qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

CompensationCompensation Committee.The Compensation Committee of the Board of Directors is responsible for the oversight and determination of executive compensation by reviewing and approving salaries and other compensation of the Company’s executive officers, and administering the Company’s equity incentive and compensation plans, including reviewing and approving stock option and other equity incentive and compensation awards to executive officers. In addition, the Compensation Committee is responsible for recommending to the Board the level and form of compensation and benefits for directors, and reviewing, recommending and taking action upon any other compensation practices or policies of the Company as the Board may request or the Committee may determine to be appropriate. The Committee has sole authority to retain and terminate a compensation consultant to assist in the evaluation of executive compensation. The Compensation Committee met sevensix times in 2013.2016. Each member of the Compensation Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

NominatingNominating and Governance Committee.Committee. The Nominating and Governance Committee of the Board of Directors recommends to the Board of Directors corporate governance principles for the Company, identifies qualified candidates for membership on the Board of Directors and proposes nominees for election as directors. The Nominating and Governance Committee met four times in 2013.2016. Each member of the Nominating and Governance Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

CommunicationsCommunications with Directors

Any shareholder who wants to communicate with members of the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board of Directors, c/o Chairman of the Board, Northwest Pipe Company, 5721 SE Columbia Way, Suite 200, Vancouver WAWashington 98661. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be submitted to the Board of Directors in a timely manner.

NominationsNominations by Shareholders In identifying qualified candidates for the Board of Directors, the Nominating and Governance Committee will consider recommendations by shareholders. Shareholder recommendations as to candidates for election to the Board of Directors may be submitted to the Company’s Corporate Secretary, Northwest Pipe Company, Attn: Corporate Secretary, 5721 SE Columbia Way, Suite 200, Vancouver, Washington 98661. The Nominating and Governance Committee will evaluate potential nominees, including candidates recommended by shareholders, by reviewing qualifications, considering references and reviewing and considering such other information as the members of the Nominating and Governance Committee deem relevant. The Company’s Corporate Governance Principles specify that the criteria used by the Nominating and Governance Committee in the selection, review and evaluation of possible candidates for vacancies on the Board should include factors relating to whether the candidate would meet the definition of “independent” as well as skills, occupation and experience in the context of the needs of the Board. All candidates for election to the Board of Directors must be individuals of character, integrity and honesty. The Company does not have a formal policy with respect to the consideration of diversity in identifying director candidates; however, the Board does considerNominating and Governance Committee Charter includes diversity as one of several criteria in recommending and reviewing a director nominee candidates. Thecandidate. From time to time, the Nominating and Governance Committee has not employed anya third partiesparty to help identify or screen prospective directors, in the past, butand may continue to do so at their discretion.

The Company’s Bylaws permit shareholders to make nominations for the election of directors, if such nominations are made pursuant to timely notice in writing to the Company’s Secretary. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the date of the meeting, provided that at least 60 daysdays’ notice or prior public disclosure of the date of the meeting is given or made to shareholders. If less than 60 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received by the Company not later than the close of business on the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made. A shareholder’s notice of nomination must also set forth certain information specified in the Company’s Bylaws concerning each person the shareholder proposes to nominate for election and the nominating shareholder.

ELECTION OF DIRECTORS

(Proposal(Proposal No. 1)

At the Annual Meeting, twothree directors will be elected, two to serve for three-year terms.terms and one to serve for a two-year term. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election of the nominees named below. The Board of Directors believes that the nominees will stand for election and will serve if elected as directors. However, if any of the persons nominated by the Board of Directors fail to stand for election or is unable to accept election, the proxies will be voted for the election of such other person as the Board of Directors may recommend.

The Company’s Articles of Incorporation provide that the Board of Directors shall be composed of not less than six and not more than nine directors. The size of the Board is currently fixed at sevensix directors. The Company’s directors are divided into three classes. The term of office of only one class of directors expires each year, and their successors are generally elected for terms of three years, and until their successors are elected and qualified. There is no cumulative voting for election of directors.

InformationInformation as to Nominees and Continuing Directors

The following table sets forth the names of and certain information about the Board of Directors’ nominees for election as a director and those directors who will continue to serve after the Annual Meeting.

| Age | Director Since | Expiration of Current Term | Expiration of Term for Which Nominated | |||||||||||||

Nominees: | ||||||||||||||||

Wayne B. Kingsley | 71 | 1987 | 2014 | 2017 | ||||||||||||

Scott J. Montross | 49 | 2013 | 2014 | 2017 | ||||||||||||

Continuing Directors: | ||||||||||||||||

Keith R. Larson | 56 | 2007 | 2015 | |||||||||||||

Richard A. Roman | 62 | 2003 | 2015 | |||||||||||||

James E. Declusin | 71 | 2010 | 2016 | |||||||||||||

Harry L. Demorest | 72 | 2013 | 2016 | |||||||||||||

Michael C. Franson | 59 | 2007 | 2016 | |||||||||||||

Age | Director Since | Expiration of Current Term | Expiration of Term for Which Nominated | |

Nominees: | ||||

Michelle Applebaum | 60 | 2014 | 2017 | 2020 |

Michael Franson | 62 | 2016 | 2017 | 2019 |

Scott Montross | 52 | 2013 | 2017 | 2020 |

Continuing Directors: | ||||

Harry Demorest | 75 | 2013 | 2019 | |

Keith Larson | 59 | 2007 | 2018 | |

Richard Roman | 65 | 2003 | 2018 |

Wayne B. KingsleyMichelle Applebaum has been a director of the Company since 1987. Mr. KingsleySeptember 2014. Ms. Applebaum is Chairmancurrently a trustee at Lake Forest College in Chicago, a Senior Advisor to Republic Partners, an industrial investment banking boutique in Chicago and an NACD Leadership and Governance Fellow. From 2003 to 2014, Ms. Applebaum built one of the Boardfirst and most successful “independent” equity research advisory boutiques. From 1981 to 2003, Ms. Applebaum was an analyst with Salomon Brothers and became ranked number one in steel equity analysis in 1988 and was promoted to Managing Director in 1994. While at Salomon Brothers, Ms. Applebaum was part of Directors of American Waterways, Inc., a privately held passenger vessel excursion company. From 1985 to 2002, Mr. Kingsley served as Chairman ofteam that built and ran the Board of Directors of InterVen Partners, Inc., a venture capital management company, offirm’s steel investment banking practice, which he was a founder and served as General Partner oftop advisor to the venture capital funds managed by InterVen Partners, Inc. Mr. Kingsley also serves on the Board of Directors of one not-for-profit entity.sector for nearly a decade. Currently, heshe is a member of our Audit Committee and Nominating and Governance Committee. Ms. Applebaum brings to the Board her relevant industry experience and insight, as well as her extensive financial expertise.

Michael Franson has been a director of the Company since August 2016. In July 2016, Mr. Franson retired from KPMG Corporate Finance LLC as Managing Director and Global Head of Technology M&A. From 2005 to 2014, Mr. Franson was a co-founder and President of St. Charles Capital LLC, an investment banking firm focused on mergers and acquisitions, raising private capital and financial advisory services for middle-market companies across the United States. From 2000 to 2005, Mr. Franson was a Managing Director at The Wallach Company, which was subsequently sold to KeyCorp, the parent of KeyBanc Capital Markets. Mr. Franson had previously served as a member of our Compensation Committee,Board of Directors from 2001 until 2005 and again from 2007 until 2014. Currently, he is the Chairman of our Nominating and Governance Committee and a member of our Compensation Committee. Mr. KingsleyFranson brings to the Board over 25 years of experience as a member of the Board of Directors and investor in the Company, as well as his background asand expertise in investment banking, including substantial experience in financial analysis and financial advisory services, merger and acquisition transactions and a managerwide variety of capital raising and investor of venture capital funds, member of investee company boards of directors, and more recent experience as a founder of and chairman of a privately held passenger vessel excursion company.financing transactions.

Scott J. Montross has been a director of the Company since January 1, 2013. Mr. Montross has served as our President and CEO since January 1, 2013, and as our Chief Operating Officer from May 2011 until December 2012. Previously he served as Executive Vice President, Flat Products Group of Evraz,EVRAZ Inc. NA from March 2010 through April 2011. Mr. Montross served as Vice President, General Manager, Evraz Oregon SteelEVRAZ Inc. NA from February 2007 through February 2010. Prior to his General Manager role, Mr. Montross served as Vice President of Marketing and Sales at Oregon Steel Mills, Inc. from June 2003 through February 2007. From 2002 to 2003, Mr. Montross was a Vice President of Marketing and Sales for National Steel Corporation. Mr. Montross brings to the Board his extensive commercial and operational experience in the steel industry.

ContinuingDirectors

Harry Demoresthas been a director of the Company since February 2013. Mr. Demorest served as CEO of Columbia Forest Products from 1996 until 2007, as President from 1994 until 1996, and as Executive Vice President from 1992 until 1994. Prior to Columbia Forest Products, Mr. Demorest was the Office Managing Partner for Arthur Andersen and Co., an independent public accounting firm, from 1981 to 1991 in Portland, Oregon. Mr. Demorest is a former board member at Columbia Forest Products, serving on its compensation and audit committees, and a former board member and audit committee chairman of Oregon Steel Mills, Inc. Mr. Demorest has also served on the boards of several civic and charitable organizations. Currently, he is the Chairman of our Audit Committee and a member of our Compensation Committee. Mr. Demorest brings to the Board his extensive financial and managerial experience.

Keith R. Larson has been a director of the Company since May 2007. Mr. Larson is a Vice President of Intel Corporation and Managing Director of Intel Capital, Intel Corporation’s venturestrategic investment group. Mr. Larson was appointed Vice President in 2006 and has served as a Managing Director of Intel Capital since 2004, managing a team of investment professionals focused on identifying, making, and managing strategic investments in the manufacturing, wearables, programmable solutions, and Intel Labs sectors.sectors, as well as the Japan region. Mr. Larson has previously managed Latin America, Taiwan and Korea regions for Intel Capital, and for approximately three months in 2004, Mr. Larson managed the Western Europe and Israel investment team of Intel Capital. From 1999 to 2003, Mr. Larson was a Sector Director managing teams of investment professionals investing in communications, networking, and data storage sectors. Mr. Larson also currently serves on the board of regents of a university, and formerly served on one state government council, which overseesoversaw approximately $80 billion in investments of various Oregon State agencies and funds such as the Oregon Public Employees Retirement Fund. Currently, he is the Chairman of our Compensation Committee and a member of our Audit Committee. Mr. Larson brings to the Board his experience as a senior executive in corporate development in a large multinational public company.company as well as his experience in corporate governance.

Richard A. Romanhas been a director of the Company since 2003. Effective January 1, 2013, Mr. Roman became the Chairman of the Board of Directors. Mr. Roman has also served as our CEO from March 2010 until December 2012, and as President from October 2010 until December 2012. Previously, Mr. Roman was the President of Columbia Ventures Corporation, a private investment company which historically has focused principally on the international metals and telecommunications industries. Prior to joining Columbia Ventures Corporation in 1992, Mr. Roman was a partner at Coopers & Lybrand, an independent public accounting firm. Mr. Roman also serves on the Board of Directors of one privately held manufacturing company and one privately held communications company. Mr. Roman brings to the Company his knowledge and experience as a partner at a large national independent public accounting firm as well as his more recent management experience as an executive officer of a private investment company.

James E. Declusin has been a director of the Company since August 2010. Mr. Declusin served as President and CEO of Evraz Inc. NA until February 2010 and as President and CEO of Oregon Steel Mills, Inc. from August 2003 until Oregon Steel Mills was acquired by Evraz Group SA in January 2007. He served as a director of Oregon Steel Mills and, subsequently, Evraz Inc. NA from 2000 until 2010. Mr. Declusin spent 16 years with California Steel Industries, most recently serving as Senior Executive Vice President and Chief Operating Officer, retiring in October 2000. Prior to that time, he spent 17 years in various management positions in the commercial area of Kaiser Steel Corporation. Currently, he is the Board’s Lead Director and a member of our Compensation Committee. Mr. Declusin brings to the Board over 40 years of experience in the steel industry, including, most recently, as president and chief executive officer of a large publicly-held steel manufacturing company.

Harry L. Demoresthas been a director of the Company since February 2013. Mr. Demorest served as CEO of Columbia Forest Products from 1996 until 2007, as President from 1994 until 1996, and as Executive Vice President from 1992 until 1994. Prior to Columbia Forest Products, Mr. Demorest was the Office Managing Partner for Arthur Anderson and Co., an independent public accounting firm, from 1981 to 1991 in Portland, Oregon. Mr. Demorest is a current board member at Columbia Forest Products, serving on its compensation and audit committees, and a former board member and audit committee chairman of Oregon Steel Mills, Inc. Mr. Demorest has also served on the boards of several civic and charitable organizations. Currently, he is the Chairman of our Audit Committee and a member of our Nominating and Governance Committee. Mr. Demorest brings to the Board his extensive financial and managerial experience.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ITS NOMINEES FOR DIRECTOR. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” THE ELECTION OF THE BOARD’S NOMINEES UNLESS A VOTE WITHHOLDING AUTHORITY IS SPECIFICALLY INDICATED. |

Michael C. Franson has been a director of the Company since January 2007. Mr. Franson is a founder and is President of St. Charles Capital LLC, an investment banking firm formed in 2005. St. Charles Capital provides expertise in mergers and acquisitions, raising private capital and financial advisory services for middle-market companies across the United States. Prior to founding St. Charles Capital, Mr. Franson was a Managing Director at The Wallach Company, which was subsequently sold to KeyCorp, the parent of KeyBanc Capital Markets.

Prior to joining The Wallach Company, Mr. Franson was a partner at Boettcher and Company, a regional investment-banking firm located in Denver. Mr. Franson began his career as an equity analyst at Pacific Mutual Insurance Company, located in Newport Beach, California. Mr. Franson had previously served as a member of our Board of Directors from 2001 until 2005. Currently, he is the Chairman of our Nominating and Governance Committee and a member of our Compensation Committee. Mr. Franson brings to the Board his background and expertise in investment banking, including substantial experience in financial analysis and financial advisory services, merger and acquisition transactions and a wide variety of capital raising and financing transactions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ITS NOMINEES FOR DIRECTOR. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” THE ELECTION OF THE BOARD’S NOMINEES UNLESS A VOTE WITHHOLDING AUTHORITY IS SPECIFICALLY INDICATED.

EXECUTIVEEXECUTIVE COMPENSATION

CompensationCompensation Discussion and Analysis

This compensation discussion and analysis provides information about our compensation program for our 20132016 Named Executive Officers:

Scott J. Montross, President and Chief Executive Officer;

● | Scott Montross, President and Chief Executive Officer; |

Robin A. Gantt, Senior Vice President and Chief Financial Officer;

● | Robin Gantt, Senior Vice President, Chief Financial Officer and Corporate Secretary; |

Robert L. Mahoney, Senior Vice President;

● | Martin Dana, Executive Vice President, Business Development and Strategy; |

Richard A. Roman, Executive Chairman of the Board of Directors through the end of 2013, and currently the Chairman; and

● | William Smith, Executive Vice President, Water Transmission; and |

● | Aaron Wilkins, Vice President of Finance and Corporate Controller. |

Gary A. Stokes, Senior Vice President (through April 15, 2014).

Further information about each of our executive officers is available in Part III – Item 1010. “Directors, Executive Officers and Corporate Governance” of our 20132016 Annual Report on Form 10-K.

CompensationPhilosophy and Objectives.The Board of Directors and executive management at the Company believe that the performance and contribution of our executive officers are critical to our overall success. To attract, retain and motivate the executives to accomplish our business strategy, the Compensation Committee establishes executive compensation policies and oversees executive compensation practices at the Company.

The Compensation Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of our specific annual and long-term goals, and which aligns executives’ interests with those of the shareholders by rewarding performance that exceeds established goals, with the ultimate objective of improving shareholder value.

The Compensation Committee also evaluates compensation programs to ensure that we maintain our ability to attract, retain and motivate superior employees in key positions and that compensation provided to key employees remains competitive.competitive when compared with other employment opportunities. The Compensation Committee believes our executive compensation packages should include both cash and share-based compensation that reward performance as measured against established goals and market performance.

In 2011, the Compensation Committee engaged an independent compensation consultant, Mercer LLC (“Mercer”), to conduct aan overall review of our executive compensation program, and to advise the Compensation Committee on the levels of base salary as well as on the design of the Company’s performance-based cash incentive program and long-term equity incentive program. To that end, Mercer developed a competitive peer group and performed benchmarking analysis of the levels and mix of compensation. The Compensation Committee used the results from this peer group and benchmarking analysis as reference data in making judgments regarding executive compensation without the implementation of a formal policy. The following peer companies were included in the analysis:

| ● Aegion Corporation | ● Ampco-Pittsburgh Corporation | |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

ProcessProcess for Setting Executive Compensation. The Compensation Committee annually reviews and approves compensation levels and pay mix for our executives.

The Compensation Committee exercises business judgment in determining the appropriate level and mix of executive compensation; cash compensation is used to provide a base salary, and to incentivize and reward our executives based on their contributions to the Company, and equityequity-based compensation is used to tie the interests of the executives to the interests of our shareholders. There is no pre-established policy or target for the allocation between either cash and non-cashnoncash or short-term and long-term incentive compensation, which enables the Compensation Committee the flexibility to adjust allocations dynamically as business conditions warrant.

The Compensation Committee uses qualitative individual performance objectives as a factor in making its decisions. The Compensation Committee and the CEO annually review the performance of each executive officer (other than the CEO whose performance is reviewed by the Compensation Committee after an evaluation from the Chairman). Based on these reviews, the Compensation Committee makes compensation decisions, including salary adjustments and annual bonus awards, for the executive officers.

The Compensation Committee evaluates and considers the Company’sCompany's annual performance within the context of its long-term strategic plan, identifying areas in which expectations were exceeded, achieved or fell below stated goals. The structure of all incentive compensation plans is reviewed periodically to assure their linkage to the current objectives, strategies and performance goals.

The Compensation Committee evaluates and considers a variety of growth and profitability measures relative to historical performance and internal plans for awarding performance-based cash incentive compensation.

The Compensation Committee evaluates and considers Total Shareholder Return, defined as the total increase in share price plus dividends, relative to peer performance and other performance criteria for awarding long-term equity incentive awards. In 2013, the members of the peer group were revised and expanded. Our 2013 performance share awards (“PSAs”) peer group differs from the companies identified by Mercer in their 2011 analysis, as the Compensation Committee performed a review in 2013 and updated the group to (i) expand the size to ensure a sufficient number of companies to stand up over time to changes in the marketplace, (ii) reflect a representation of the companies whose scope of operations were generally consistent with the Company’s size and complexity, and (iii) represent the external market for senior talent. The 2013 PSA peer group was comprised of the following companies:

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

| ||||

| ||||

• | The Compensation Committee generally does not utilize specific benchmark levels. Rather, the Compensation Committee considers broad, market based survey data of comparable companies, such as that provided by Mercer, |

From time to time, the Compensation Committee has retained Mercer to advise the Committee on executive or director compensation matters, to assess total compensation program levels and program elements for executive officers or directors, and to evaluate marketplace trends in executive or director compensation. For 2013,In so doing, the Compensation Committee didhas considered all relevant factors that could give rise to a potential conflict of interest with Mercer, and has determined that none exist. In 2015, the Compensation Committee retained Mercer to perform a limited review of compensation programs for various employee groups. No changes were made during the year to executive or director compensation as a result of their review.

AdvisoryVote on Executive Compensation.Each year the Compensation Committee submits to shareholders an advisory resolution on executive compensation, and carefully considers the voting results of this proposal, though the final vote is advisory in nature and therefore not retain Mercer.binding on the Company. Our shareholders expressed strong support for our executive compensation program in the advisory vote at our 2016 Annual Meeting of Shareholders. Based upon these results, the Compensation Committee has determined to follow the shareholders’ recommendation by continuing our present compensation policies and practices.

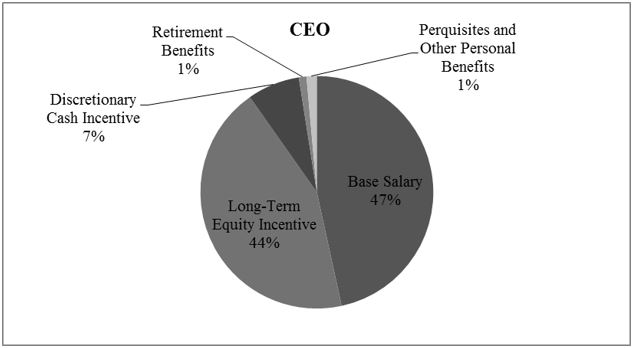

ElementsElements of Compensation.For the year ended December 31, 2013,2016, the principal targeted components of compensation for executive officers were:

base salary;

performance-based cash incentive compensation;

long-term equity incentive awards (restricted stock units (“RSUs”) and performance share awards)awards (“PSAs”));

retirement benefits; and

perquisites and other personal benefits.

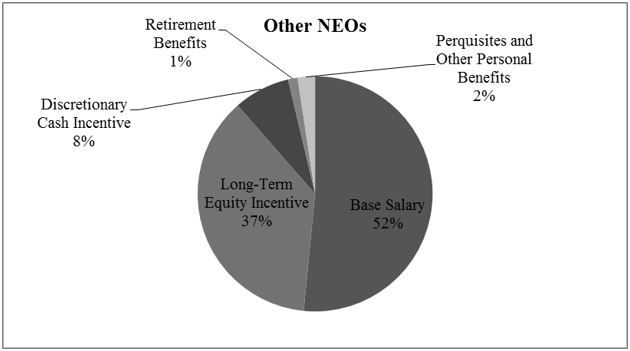

The target weighting of each of the components of compensation for the CEO and other Named Executive Officers was as follows for the year ended December 31, 2016:

|

|

RealizedPay vs. Reported Pay. In the following table, Reported Pay is compensation reflected in the Summary of Cash and Certain Other Compensation table on page 16. Realized Pay is compensation actually received by the Named Executive Officer during the year, including salary, performance-based and discretionary cash incentive compensation, market values at vesting of previously granted RSUs and PSAs and All Other Compensation amounts received during the year. Realized Pay was less than Reported Pay in 2016 for all Named Executive Officers, as the value of the equity awards received by the Named Executive Officers was less than the grant date fair value of awards granted.

2016 | 2015 | 2014 | ||||||||||||||||||||||

Realized Pay | Reported Pay | Realized Pay | Reported Pay | Realized Pay | Reported Pay | |||||||||||||||||||

Scott Montross | $ | 676,066 | $ | 1,137,944 | $ | 925,636 | $ | 630,134 | $ | 1,188,227 | $ | 1,394,848 | ||||||||||||

Robin Gantt | 382,604 | 605,328 | 494,318 | 355,306 | 607,637 | 596,803 | ||||||||||||||||||

Martin Dana | 380,745 | 603,418 | 438,744 | 364,817 | 488,258 | 638,411 | ||||||||||||||||||

William Smith | 382,563 | 604,965 | 452,073 | 377,705 | 651,800 | 747,214 | ||||||||||||||||||

Aaron Wilkins | 237,679 | 337,098 | 171,075 | 169,577 | 135,358 | 168,309 | ||||||||||||||||||

BaseBase Salary.We provide executive officers and other employees with a base salary to compensate them for services rendered during the fiscal year. Base salaries are determined for each executive based on his or her experience, position and responsibilities, and takestake in to consideration market data and conditions. In addition, we consider the individual performance of each executive, and conduct internal reviews of each executive’s compensation to ensure equity among executive officers. Salary levels are typically reviewed annually as part of our performance review process as well as upon a promotion or other change in job responsibility. Merit based increases to salaries are based on the Compensation Committee’s assessment of the individual executive’s performance in conjunction with recommendations provided by the CEO.

Base salary is reflected in the ‘Salary’ column in the Summary of Cash and Certain Other Compensation table on page 14.16.

PerformancePerformance-Based-Based Cash Incentive Compensation.We provide executive officers and other employees with incentive compensation to retain, incentivize and reward them for high performance and achievement of corporate goals. The incentive compensation program provides for an award of cash incentive compensation to executive officers and others as a reward for our growth and profitability, and places a significant percentage of each executive officer’s compensation at risk. Awards are based on our achievement of certain financial performance measures each year.

The performance measure for 2013 for Messrs. Montross and Mahoney and Ms. Gantt

For 2016, no performance-based incentive compensation was Adjusted Income before Income Taxes, for which the Compensation Committee established a target level of $36.5 million. Adjusted Income before Income Taxes is calculated by adjusting our income before income taxes as reported in our audited financial statements for certain events that occur during the year, such as the acquisitions of businesses, the sales of significant capital assets, or other extraordinary or unusual developments. For 2013, Adjusted Income before Income Taxes excludes the loss on the impairment of fixed assets.

Performance measures for 2013 for Mr. Stokes were Adjusted Income before Income Taxes and Water Transmission Operating Income, for which the Compensation Committee established target levels of $36.5 million and $44.5 million, respectively. Fifty percent of Mr. Stokes’s award is based on each performance measure. Operating Income is calculated by applying to our segment operating income as reported in our audited financial statements the same adjustments made to Adjusted Income before Income Taxes, as those adjustments relate specificallyawarded to the respective business segment.

Mr. Roman was not eligible to participate in our Performance-Based Cash Incentive Compensation.

The Compensation Committee also establishedexecutive officers, as a payout range for the awards for each executive officer based on the level of achievementresult of the performance measure. For Mr. Montross, the target payout for 2013 was

seventy percent of 2013 annual base salary upon achievement of one hundred percent of the performance target, with the payout range extending from $0 at or below fifty percent of target performance to one hundred and forty percent of 2013 base salary at or above one hundred and thirty percent of target performance. For Messrs. Mahoney and Stokes and Ms. Gantt, the target payout for 2013 was fifty percent of 2013 annual base salary upon achievement of one hundred percent of performance target, with the payout range extending from $0 at or below fifty percent of target performance to one hundred percent of 2013 annual base salary at or above one hundred and thirty percent of target performance. Payouts for performance within the range will be interpolated on a straight line basis. Even if the performance measures are met, the Compensation Committee retains the right to adjust the actual amounts of the award to each individual at its discretion. Such adjustments may be based on individual performance, as well as external factors affecting us or the occurrence of unusual or infrequent events; in 2013, Mr. Montross’s award was reduced by 5% for adjustments based on individual performance. The following table reflects, for each of the Named Executive Officers, the applicable performance target, actual performance and amount of award:prolonged market challenges we have faced.

Name | 2013 Performance Target (million $) | 2013 Actual Performance (million $) | 2013 Target Award ($) | 2013 Actual Award ($) | ||||||||||||

Scott Montross | $ | 36.5 | $ | 24.5 | $ | 350,000 | $ | 112,970 | ||||||||

Robin A. Gantt | 36.5 | 24.5 | 137,469 | 46,706 | ||||||||||||

Robert L. Mahoney | 36.5 | 24.5 | 152,353 | 51,763 | ||||||||||||

Gary A. Stokes | ||||||||||||||||

Adjusted Income before Income Taxes | 36.5 | 24.5 | 76,197 | 25,889 | ||||||||||||

Water Transmission Operating Income | 44.5 | 40.3 | 76,197 | 61,961 | ||||||||||||

Performance-based cash incentive compensation, if awarded, is reflected in the ‘Non-Equity Incentive Plan Compensation’ column in the Summary of Cash and Certain Other Compensation table on page 14.16.

DiscretionaryDiscretionary Incentive Compensation.We provide, from time to time, additional discretionary incentive compensation in recognition of an executive officer’sofficer's or other employee’semployee's success in attaining results that delivered value to the Company, but were not captured in the performance-based cash incentive compensation, or for other reasons as determined appropriate by the Compensation Committee. In 2013, Mr. Stokes received discretionary incentive compensation

Discretionary incentive compensation, if awarded, is reflected in the ‘Bonus’ column in the Summary of Cash and Certain Other Compensation table on page 14.16. In 2016, we entered into Long Term Incentive Plan agreements with Mr. Montross, Ms. Gantt, Mr. Dana and Mr. Smith providing for cash payments payable in two equal installments in 2016 and 2017, subject to continued employment through the applicable payment date and satisfactory performance. Also in 2016, we entered into a Retention Agreement with Mr. Wilkins providing for cash payments payable in installments in 2016 and 2017, subject to eligibility requirements. There was no discretionary incentive compensation awarded in 2015 or 2014.

LongLong-Term-Term Equity Incentive Awards. We provide long-term equity incentive awards to executive officers and certain designated key employees. The long-term equity incentive awards are designed to ensure that our executive officers and key employees have a continuing stake in our long-term success. In addition, the awards emphasize pay-for-performance. Terms and conditions of the awards are determined on an annual basis by the Compensation Committee. The amount of the equity award in 2013 was determined based on a percentage of the recipient’s base salary; the equity award at target was eighty-five percent for the Named Executive Officers, other than the CEO, whose award was one hundred and fifty percent, and the Executive Chairman of the Board, who was not

When granted, an award. Under the grant, twenty five percent of the award was in the form of restricted stock units (“RSUs”), and seventy five percent of the award was in the form of PSAs.

RSUs are service-based and entitle the holder to receive Common Stock at the end of the vesting period (one-third of the 2013 awards vested in seven months, one-third vest in nineteen months,(generally over periods ranging from one and one-third vest in thirty-one months)a half to three years), subject to continued employment. RSUs are designed to attract and retain executive officers and others by providing them with the benefits associated with the increase in the value of the Common Stock during the vesting period, while incentivizing them to remain with us long-term.

When granted, PSAs are service-based awards with a market-based vesting condition. PSAs serve several purposes. They have value to the holder only if the goals are achieved during their performance measurement period and they serve as a retention tool because certain of the 2013 awards’ performance measurement periods generally extend to December 31, 2015.over approximately three years. Additionally, the holders benefit further if they are successful in increasing the value of our Common Stock. The 2013When PSAs wereare granted, withthey include a market-based vesting condition that entitleentitles the holder to receive between zero and two hundred percent of the target award, based on our Total Shareholder Return compared to our 2013 PSA peer group.

The market-based PSAs vest in January 2016, following the 2013 – 2015 measurement period. The following scale shows the adjustment to the number of PSAs that may be awarded following the measurement period:

Total Shareholder Return vs. Peer Group | Payout as a Percentage of | |||

85th percentile or higher | 200% | |||

| ||||

| 100% | |||

25th percentile | 25% | |||

Less than 25th percentile | 0% | |||

Payouts for performance between the rankings will be interpolated on a straight linestraight-line basis.

Long-term equity incentive awards are reflected in the ‘Stock Awards’ column in the Summary of Cash and Certain Other Compensation table on page 14.16. These amounts represent the target value of the award issued, but not what was actually received by the Named Executive Officer.

RetirementRetirement Benefits. In order to provide competitive total compensation,Until the plan was frozen in 2016, we offeroffered our executive officers and certain designated key employees a nonqualified retirement savings plan (the “Deferred Compensation Plan”), which providesprovided executive officers and others with the opportunity to defer salary and bonus compensation for a period of years or until termination of employment. Executive officers who deferdeferred salary or bonus under the Deferred Compensation Plan are credited with market-based returns. We may make a discretionaryDiscretionary matching contributioncontributions were made based on deferrals made by each participant. In addition, we will makemade a contribution based on a target benefit projected for each participant. The target benefit projected iswas 1% of base salary in the year before attaining normal retirement age per year of employment (up to 35 years) with us. For 2013, Company contributions to the Deferred Compensation Plan accounted for between one and four percent of the total compensation for each of the Named Executive Officers.

We also offer a qualified 401(k) defined contribution plan. The ability of executive officers to participate fully in this plan is limited under IRS and ERISA requirements. The 401(k) plan encourages employees to save for retirement by investing on a regular basis through payroll deductions.

Retirement benefits are reflected in the ‘All Other Compensation’ column in the Summary of Cash and Certain Other Compensation table on page 14.16.

PerquisitesPerquisites and Other Personal Benefits. We provide executive officers with perquisites and other personal benefits that we and the Compensation Committee believe are reasonable and consistent with our overall compensation program to better enable us to attract, retain and motivate employees for key positions. We are selective in our use of perquisites, utilizing perquisites that are commonly provided, the value of which is generally modest. The Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to executive officers. The primary perquisites are car allowances and life insurance premiums.

Perquisites and other personal benefits are reflected in the ‘All Other Compensation’ column in the Summary of Cash and Certain Other Compensation table on page 14.16.

ExecutiveExecutive Compensation and Risk. Although a substantial portion of the compensation paid to our executive officers is performance-based, weWe believe our executive compensation programs do not encourage

excessive and unnecessary risk-taking by our executive officers because theseour programs are designed to encourage our executive officers to remain focused on both the short-term and long-term operational and financial goals of the Company. We achieve this balance through a combination of elements in our overall compensation plans, including: elements that reward different aspects of short-term and long-term performance; incentive compensation that rewards performance on a variety of different measures; awards that are paid based on results averaged out over several years; and awards paid in cash and awards paid in shares of the Company’s stock, to encourage better alignment with the interests of shareholders. Additionally, annual compensation decisions for executive officers are influenced by the review of the performance of each executive officer by the Compensation Committee, including an evaluation of the officers’ commitment to promoting effective internal controls and legal and regulatory compliance. We believe this helps to ensure “the tone at the top” deters unnecessary risk-taking.

ClawbackClawback Provisions. Our performance-based cash incentive compensation program contains a provision that allows the Company to recapture amounts paid to the Named Executive Officers under certain circumstances. If the Company’s financial statements are the subject of a restatement due to misconduct, to the extent permitted by governing law, in all appropriate cases, the Company will seek reimbursement of excess incentive cash compensation paid under the program for the relevant years. For purposes of this provision, excess incentive cash compensation means the positive difference, if any, between (i) the award paid to the Named Executive Officer and (ii) the award that would have been made to the Named Executive Officer, not including the effect of any discretionary reductions made by the Committee, had the target award been calculated based on the Company’s financial statements as restated.

StockStock Ownership and Anti-Hedging/Pledging Policy. The Nominating and Governance Committee of the Board of Directors has adopted a stock ownership policy because it believes it is in the best interests of the Company and its shareholders to align the financial interests of our executive officers and directors with those of the Company’s shareholders. Under the policy, the directors are expected to accumulate and own shares having a market value equal to three times their annual cash retainer; the CEO is expected to accumulate and own shares having a market value equal to three times his base salary; and each of the other Named Executive Officers is expected to accumulate and own shares having a market value equal to either one or two times his or her base salary.salary, depending on his or her position with the Company. Each executive officer or director has five years to accumulate the expected ownership level beginning from the later of September 2011 or their date of hire or promotion. In addition, executive officers and directors are expressly prohibited from engaging in hedging transactions related to the Company’s stock, including trading in publicly-traded options, puts, calls or other derivative instruments related to the Company’s stock, and from pledging the Company’s stock as collateral for a loan.

Advisory Vote on Executive Compensation.The Compensation Committee carefully considers the voting results of this proposal each year, though the final vote is advisory in nature and therefore not binding on the Company. Our shareholders expressed strong support for our executive compensation program in the advisory vote at our 2013 Annual Meeting of Shareholders. Based upon these results, the Compensation Committee has determined to follow the shareholders’ recommendation by continuing our present compensation policies and practices.

SummarySummary of Cash and Certain Other Compensation

The following table reflects compensation earned by our CEO, our CFO, and each of the three other most highly compensated executive officers, for the years ended December 31, 2013, 20122016, 2015 and 20112014 (the “Named Executive Officers”).

Summary Compensation Table

Name and Principal Position | Year | Salary(1) | Bonus(2) | Stock Awards(3) | Non-Equity Incentive Plan Compensation | All Other Compensation | Total ($) | |||||||||||||||||||||

Scott J. Montross (4) | 2013 | $ | 500,000 | — | $ | 933,963 | $ | 112,970 | $ | 52,950 | (5) | $ | 1,599,883 | |||||||||||||||

Director, Chief Executive | 2012 | 400,000 | — | 521,645 | 97,065 | 16,110 | (5) | 1,034,820 | ||||||||||||||||||||

| 2011 | 244,100 | — | 449,542 | 236,607 | 9,623 | (5) | 939,872 | |||||||||||||||||||||

Robin A. Gantt | 2013 | 274,938 | — | 294,536 | 46,706 | 34,737 | (6) | 650,917 | ||||||||||||||||||||

Senior Vice President, Chief | 2012 | 265,000 | $ | 25,000 | (7) | 279,759 | 51,036 | 32,548 | (6) | 653,343 | ||||||||||||||||||

| 2011 | 221,900 | — | 202,292 | 153,616 | 15,180 | (6) | 592,988 | |||||||||||||||||||||

Robert L. Mahoney Senior Vice President | 2013 | 304,705 | — | 324,898 | 51,763 | 50,937 | (8) | 732,303 | ||||||||||||||||||||

| 2012 | 298,000 | — | 314,603 | 57,392 | 52,354 | (8) | 722,349 | |||||||||||||||||||||

| 2011 | 264,600 | — | 267,938 | 101,476 | 44,972 | (8) | 678,986 | |||||||||||||||||||||

Richard A. Roman | 2013 | 505,000 | — | — | — | 26,591 | (9) | 531,591 | ||||||||||||||||||||

Director, Executive Chairman | 2012 | 530,000 | — | 310,504 | 135,756 | 59,742 | (9) | 1,036,002 | ||||||||||||||||||||

| 2011 | 530,000 | 125,000 | (10) | 1,381,267 | 513,726 | — | 2,549,993 | |||||||||||||||||||||

Gary A. Stokes | 2013 | 304,787 | 2,870 | (11) | 324,971 | 87,849 | 58,504 | (12) | 778,981 | |||||||||||||||||||

Senior Vice President | 2012 | 298,000 | — | 314,689 | 48,796 | 57,173 | (12) | 718,658 | ||||||||||||||||||||

| 2011 | 295,600 | — | 268,008 | 250,096 | 55,019 | (12) | 868,723 | |||||||||||||||||||||

Name and Principal Position | Year | Salary(1) | Bonus | Stock Awards(2) | All Other Compensation | Total ($) | ||||||||||||||||

Scott Montross | 2016 | $ | 530,000 | $ | 82,813 | $ | 496,877 | $ | 28,254 | (3) | $ | 1,137,944 | ||||||||||

Director, Chief Executive | 2015 | 530,000 | - | - | 100,134 | (3) | 630,134 | |||||||||||||||

Officer and President | 2014 | 500,000 | - | 869,988 | 24,860 | (3) | 1,394,848 | |||||||||||||||

Robin Gantt | 2016 | 312,000 | 39,000 | 234,003 | 20,325 | (4) | 605,328 | |||||||||||||||

Senior Vice President, Chief | 2015 | 303,735 | - | - | 51,571 | (4) | 355,306 | |||||||||||||||

Financial Officer | 2014 | 288,685 | - | 288,100 | 20,018 | (4) | 596,803 | |||||||||||||||

Martin Dana | 2016 | 308,040 | 38,500 | 231,001 | 25,877 | (5) | 603,418 | |||||||||||||||

Executive Vice President | 2015 | 308,040 | - | - | 56,777 | (5) | 364,817 | |||||||||||||||

2014 | 308,040 | - | 303,722 | 26,649 | (5) | 638,411 | ||||||||||||||||

William Smith | 2016 | 308,040 | 38,500 | 231,001 | 27,424 | (6) | 604,965 | |||||||||||||||

Executive Vice President | 2015 | 308,040 | - | - | 69,666 | (6) | 377,706 | |||||||||||||||

2014 | 308,040 | - | 303,722 | 135,452 | (6) | 747,214 | ||||||||||||||||

Aaron Wilkins(7) | 2016 | 180,767 | 50,400 | 99,995 | 5,936 | (8) | 337,098 | |||||||||||||||

Vice President, Corporate | 2015 | 165,021 | - | - | 4,556 | (8) | 169,577 | |||||||||||||||

Controller | 2014 | 134,896 | - | 32,951 | 462 | (8) | 168,309 | |||||||||||||||

___

(1) | Includes amounts earned in each of the respective years, even if deferred. |

(2) |

| The amounts included in this column represent the aggregate grant date fair value of RSUs and PSAs granted during the years reported in accordance with FASB ASC Topic 718. The assumptions used to calculate the grant date fair value for the stock awards are in Note 12 of the Notes to the Consolidated Financial Statements included in Part II – Item |

(3) |

Includes amounts paid by us for contributions to Mr. |

(4) | Includes amounts paid by us for contributions to Ms. Gantt’s qualified 401(k) defined contribution plan, life insurance premiums, |

(5) |

Includes amounts paid by us for contributions to Mr. |

(6) | Includes amounts paid by us for contributions to Mr. Smith’s qualified 401(k) defined contribution plan, life insurance premiums and annual automobile |

(7) | Mr. Wilkins was promoted to Vice President of Finance and Corporate Controller in September 2016. |

(8) | Includes amounts paid by us for contributions to Mr. |

2016Grants of Plan-Based Awards

Plan-based awards granted in 2016 represent RSUs granted under the long-term equity incentive plan. The methodology applied in determining these awards and how they are earned is discussed under “Long-Term Equity Incentive Awards” above.

Name | Grant Date | Number of Shares of Stock or Units (#) | Grant Date Fair Value of Stock Awards(1) | |||||||

Scott Montross | 04/19/2016 | 52,972 | $ | 496,877 | ||||||

Robin Gantt | 04/19/2016 | 24,947 | 234,003 | |||||||

Martin Dana | 04/19/2016 | 24,627 | 231,001 | |||||||

William Smith | 04/19/2016 | 24,627 | 231,001 | |||||||

Aaron Wilkins | 09/22/2016 | 8,503 | 99,995 | |||||||

(1) |

The amounts |

2013 Grants of Plan-BasedAwards

The following table reflects grants of long-term equity incentive awards granted to each of the eligible Named Executive Officers for the year ended December 31, 2013.

| Grant Date | Estimated Future Payouts Under Equity Incentive Plan Awards | Grant Date Fair Value of Stock Awards (1) | ||||||||||||||||||

Name | Threshold (#) | Target (#) | Maximum (#) | |||||||||||||||||

Scott J. Montross | 05/31/2013 | (2) | — | 6,821 | 6,821 | $ | 187,509 | |||||||||||||

| 05/31/2013 | (3) | — | 20,462 | 40,924 | 746,454 | |||||||||||||||

Robin A. Gantt | 05/31/2013 | (2) | — | 2,151 | 2,151 | 59,131 | ||||||||||||||

| 05/31/2013 | (3) | — | 6,453 | 12,906 | 235,405 | |||||||||||||||

Robert L. Mahoney | 05/31/2013 | (2) | — | 2,373 | 2,373 | 65,234 | ||||||||||||||

| 05/31/2013 | (3) | — | 7,118 | 14,236 | 259,665 | |||||||||||||||

Richard A. Roman | — | — | — | — | — | |||||||||||||||

| — | — | — | — | — | ||||||||||||||||

Gary A. Stokes | 05/31/2013 | (2) | — | 2,373 | 2,373 | 65,234 | ||||||||||||||

| 05/31/2013 | (3) | — | 7,120 | 14,240 | 259,738 | |||||||||||||||

OutstandingOutstanding Equity Awards at 20132016 Fiscal Year End

The following table sets forth, for each of the Named Executive Officers, the equity awards made to each such Named Executive Officer that were outstanding atas of December 31, 2013.2016.

| Option Awards | Stock Awards | |||||||||||||||||||||||

| Number of Securities Underlying Unexercised Options (#) | Option Exercise Price ($) | Option Expiration Date | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) | ||||||||||||||||||||

Name | Exercisable | Unexercisable | ||||||||||||||||||||||

Scott J. Montross | — | — | — | — | 1,893 | (2) | $ | 71,480 | ||||||||||||||||

| — | — | — | — | 3,788 | (3) | 143,035 | ||||||||||||||||||

| — | — | — | — | 2,991 | (4) | 112,940 | ||||||||||||||||||

| — | — | — | — | 4,487 | (5) | 169,429 | ||||||||||||||||||

| — | — | — | — | 8,975 | (6) | 338,896 | ||||||||||||||||||

| — | — | — | — | 6,821 | (7) | 257,561 | ||||||||||||||||||

| — | — | — | — | 20,462 | (8) | 772,645 | ||||||||||||||||||

Robin A. Gantt | — | — | — | — | 851 | (2) | 32,134 | |||||||||||||||||

| — | — | — | — | 1,705 | (3) | 64,381 | ||||||||||||||||||

| — | — | — | — | 1,604 | (4) | 60,567 | ||||||||||||||||||

| — | — | — | — | 2,407 | (5) | 90,888 | ||||||||||||||||||

| — | — | — | — | 4,813 | (6) | 181,739 | ||||||||||||||||||

| — | — | — | — | 2,151 | (7) | 81,222 | ||||||||||||||||||

| — | — | — | — | 6,453 | (8) | 243,665 | ||||||||||||||||||

Robert L. Mahoney | — | — | — | — | 1,128 | (2) | 42,593 | |||||||||||||||||

| — | — | — | — | 2,258 | (3) | 85,262 | ||||||||||||||||||

| — | — | — | — | 1,804 | (4) | 68,119 | ||||||||||||||||||

| — | — | — | — | 2,706 | (5) | 102,179 | ||||||||||||||||||

| — | — | — | — | 5,413 | (6) | 204,395 | ||||||||||||||||||

| — | — | — | — | 2,373 | (7) | 89,604 | ||||||||||||||||||

| — | — | — | — | 7,118 | (8) | 268,776 | ||||||||||||||||||

Richard A. Roman | 2,000 | (9) | — | $ | 14.000 | 5/11/2014 | — | — | ||||||||||||||||

| 2,000 | (10) | — | 22.070 | 5/10/2015 | — | — | ||||||||||||||||||

| 2,000 | (11) | — | 28.310 | 5/9/2016 | — | — | ||||||||||||||||||

| 2,000 | (12) | — | 34.770 | 5/30/2017 | — | — | ||||||||||||||||||

| 24,000 | (13) | — | 24.150 | 3/29/2020 | — | — | ||||||||||||||||||

| — | — | — | — | 4,016 | (2) | 151,644 | ||||||||||||||||||

| — | — | — | — | 8,030 | (3) | 303,213 | ||||||||||||||||||

| — | — | — | — | 1,781 | (4) | 67,251 | ||||||||||||||||||

| — | — | — | — | 2,671 | (5) | 100,857 | ||||||||||||||||||

| — | — | — | — | 5,342 | (6) | 201,714 | ||||||||||||||||||

Gary A. Stokes | — | — | — | — | 1,129 | (2) | 42,631 | |||||||||||||||||

| — | — | — | — | 2,259 | (3) | 85,300 | ||||||||||||||||||

| — | — | — | — | 1,805 | (4) | 68,157 | ||||||||||||||||||

| — | — | — | — | 2,707 | (5) | 102,216 | ||||||||||||||||||

| — | — | — | — | 5,414 | (6) | 204,433 | ||||||||||||||||||

| 2,373 | (7) | 89,604 | ||||||||||||||||||||||

| 7,120 | (8) | 268,851 | ||||||||||||||||||||||

Stock Awards | ||||||||

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not | |||||||

Name | Vested (#) | Vested ($)(1) | ||||||

Scott Montross | 1,736 | (2) | $ | 29,894 | ||||

| 15,625 | (3) | 269,063 | ||||||

| 52,972 | (4) | 912,178 | ||||||

Robin Gantt | 575 | (2) | 9,902 | |||||

| 5,174 | (3) | 89,096 | ||||||

| 24,947 | (4) | 429,587 | ||||||

Martin Dana | 606 | (2) | 10,435 | |||||

| 5,455 | (3) | 93,935 | ||||||

| 24,627 | (4) | 424,077 | ||||||

William Smith | 606 | (2) | 10,435 | |||||

| 5,455 | (3) | 93,935 | ||||||

| 24,627 | (4) | 424,077 | ||||||

Aaron Wilkins | 65 | (2) | 1,119 | |||||

| 592 | (3) | 10,194 | ||||||

| 8,503 | (5) | 146,422 | ||||||

___

(1) | Market value is based on the closing market price of |

(2) | These RSUs were granted on |

(3) | These PSAs were granted on |

(4) | These RSUs were granted on |

(5) |

| These RSUs were granted on |

20162013 Option Exercises and Stock VestingVested

The following table sets forth, for each Named Executive Officer, the number of shares acquired upon option exercises and vesting of stock awards during 2013,2016 and the related value realized upon such exercises and vesting.

| Option Awards | Stock Awards | |||||||||||||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) | Number of Shares Acquired on Vesting (#)(2) | Value Realized on Vesting ($)(3) | ||||||||||||

Scott J. Montross | — | — | 11,951 | $ | 285,151 | |||||||||||

Robin A. Gantt | — | — | 5,507 | 131,397 | ||||||||||||

Robert L. Mahoney | — | — | 7,133 | 170,193 | ||||||||||||

Richard A. Roman | 7,000 | $ | 116,830 | 23,054 | 550,068 | |||||||||||

Gary A. Stokes | — | — | 7,134 | 170,217 | ||||||||||||

Stock Awards | ||||||||

Name | Number of Shares Acquired on Vesting (#)(1) | Value Realized on Vesting ($)(2) | ||||||

Scott Montross | 4,009 | $ | 34,999 | |||||

Robin Gantt | 1,292 | 11,279 | ||||||

Martin Dana | 954 | 8,328 | ||||||

William Smith | 985 | 8,599 | ||||||

Aaron Wilkins | 66 | 576 | ||||||

___

(1) |

| This column shows the number of shares acquired on vesting in |

(2) | The value realized on vesting is based on the closing market price multiplied by the number of shares of stock vested on the applicable vesting date. |

20162013 Nonqualified Deferred Compensation

The following table sets forth, for each Named Executive Officer under our Deferred Compensation Plan, which was frozen in 2016, the amounts of the contributions made by each executive, the contributions made by us, the earnings generated by the investments within the Plan, and the balance of each Named Executive Officer’s account under the Deferred Compensation Plan for the year ended December 31, 2013.2016.

Name | Executive Contributions in Last Fiscal Year | Company Contributions in Last Fiscal Year(1) | Aggregate Earnings (Loss) in Last Fiscal Year ($) | Aggregate Balance at Last Fiscal Year-End(2) | ||||||||||||

Scott J. Montross | $ | — | $ | 28,055 | $ | 1,644 | $ | 29,699 | ||||||||

Robin A. Gantt | — | 12,692 | 2,909 | 28,232 | ||||||||||||

Robert L. Mahoney | 12,191 | 26,233 | 92,352 | 958,205 | ||||||||||||

Richard A. Roman | — | 13,747 | 8,171 | 71,418 | ||||||||||||

Gary A. Stokes | 15,239 | 31,278 | 84,856 | 900,279 | ||||||||||||

Name | Executive Contributions in Last Fiscal Year | Company Contributions in Last Fiscal Year(1) | Aggregate Earnings (Loss) in Last Fiscal Year ($) | Aggregate Balance at Last Fiscal Year-End(2) | ||||||||||||

Scott Montross | $ | - | $ | - | $ | 7,476 | $ | 110,539 | ||||||||

Robin Gantt | - | - | 7,676 | 72,040 | ||||||||||||

Martin Dana | - | - | 19,118 | 232,771 | ||||||||||||

William Smith | - | - | 2,102 | 32,354 | ||||||||||||

Aaron Wilkins | - | - | - | - | ||||||||||||

__

(1) | The Company ceased contributions |

(2) | The following portion of the amounts in the Aggregate Balance at Last Fiscal Year-End column were reported in the Summary Compensation Table of previous years in the Salary column (in the case of executive contributions) or in the All Other Compensation column (in the case of Company contributions), respectively: Mr. Montross - $0 and $71,987, respectively in 2015 and $0 and $0, respectively in 2014; Ms. Gantt |

EmploymentEmployment Agreements

Gary A. StokesOn March 31, 2014, we